E-tax

Focus area for ASToN

Kumasi’s chosen policy area is E-Tax

Kumasi’s chosen policy area is E-Tax

The KMA currently finds it difficult to assess and collect revenues from properties and businesses, particularly because the unavailability of approved local planning schemes makes it difficult to identify them at the correct rate. This means that the authority is only able to access approximately half the potential revenue from these taxes.

Additionally, tax collection is done manually, which makes it difficult to collect and report on tax. Data storage is also a major problem within the Assembly, with available data stored in different offices and locations, which makes the gathering of comprehensive information for tax assessment, collection, and reporting very difficult.

There is particular anxiety within the KMA that an inability to increase their revenue through taxation will make current development gains unsustainable when development finance leaves the region.

Findings: the starting point for addressing these problems

The following findings set out the starting point for Kumasi as they work to address tax collection. Based on research conducted over the course of Phase 1, they describe the interlinked strengths and challenges that need to be taken into account.

The city authority has a clearly defined problem with high-impact potential

The KMA has a detailed understanding of the challenges and barriers to address the issue of tax collection. Additional revenue collection could catalyse improvement in other public services.

Kumasi has strong capacity to attract partnerships outside of the local ecosystem

Kumasi has a good track record working with donor organisations and tech partners (such as Heinz Integrated Systems). However, there have been limited working relationships with the tech & start-up ecosystem present within Kumasi that could be utilised.

Strong political commitment to the project must be matched with the improvements in public administration

While the Mayor has identified Sustainable Digital Revenue Mobilization as one of his priority areas, KMA is yet to put in place measures to address it’s complicated decision-making processes, with multiple layers of administration systems, and data that exist in silos at different offices.

The KMA has limited capacity to engage with the collection of data

Data collection in the KMA is mostly paper-based and siloed, with little-to-no sharing between departments. Furthermore, there is no policy to ensure data completeness or regular updates, and the last full property audit was done in 2010. Finally, there is inadequate IT infrastructure to support data collection and storage.

Digital solutions could improve a confusing system but may not overcome citizen preferences surrounding taxation

In Kumasi, the presence of multiple billing and communications systems are very confusing for citizens, and there is potential for digital technology to improve the public offering in this regard. However, any solution must consider the preference of some citizens to use cash payments when paying their taxes.

Next steps

For Phases 2 and 3, the KMA has yet to produce a digital transformation strategy.

The Local Action Plan will be one of the key elements of the strategy when it is created.

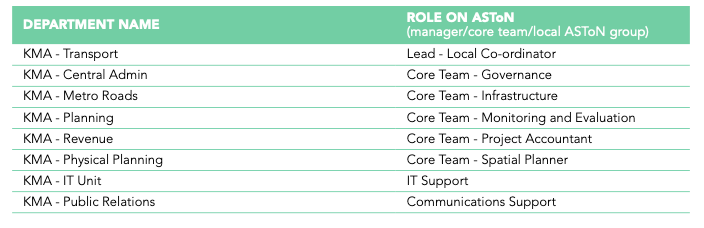

Departments of the authority involved in the project

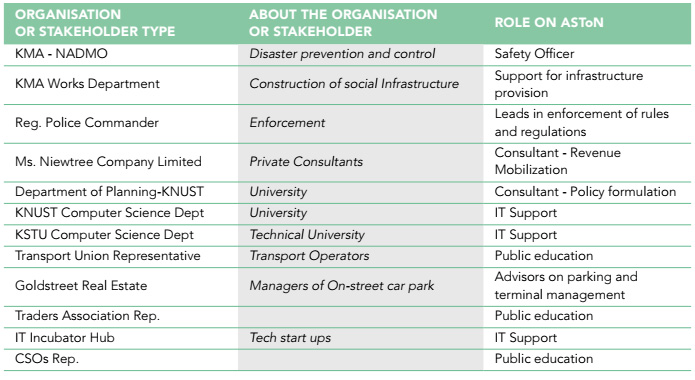

Stakeholders involved in the ASToN Local Group

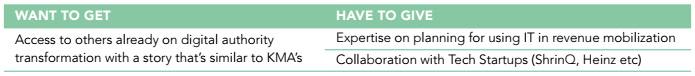

Participating in the ASToN network